The rapid evolution of technology has profoundly transformed the business landscape, particularly for online businesses. Digital transformation is no longer just a buzzword, driving changes in customer expectations, operational efficiencies, and revenue generation models. At the heart of this shift is how businesses handle payments and engage with customers. E-commerce businesses, fintech companies, and even traditional retailers are now optimizing their payment systems, embracing new models like open banking to enhance both the user experience and the business’s bottom line.

The importance of optimizing payment solutions and customer engagement cannot be overstated. With consumer behaviors shifting toward mobile-first experiences and seamless, real-time transactions, businesses that lag in adapting payment solutions risk losing customers. Payment innovations, such as direct bank payments, reduce friction and fees, making it easier for businesses to streamline operations while increasing conversion rates. Moreover, optimizing customer engagement—through personalized offers and seamless transactions—directly translates into higher customer loyalty, satisfaction, and, ultimately, revenue growth.

How these five strategies can help online businesses thrive in a competitive market lies in their focus on both cost efficiency and customer-centricity. By implementing payment systems that reduce operational costs and by leveraging data-driven insights to engage with customers more effectively, businesses can unlock new revenue streams and outpace competitors.

Strategy 1: Reducing Transaction Costs to Boost Margins

One of the most direct ways for online businesses to improve their profitability is by reducing transaction fees. Traditional payment methods, such as credit cards, come with high processing fees—typically ranging from 2-3% per transaction. For businesses handling high transaction volumes, these fees quickly add up, cutting into their profit margins.

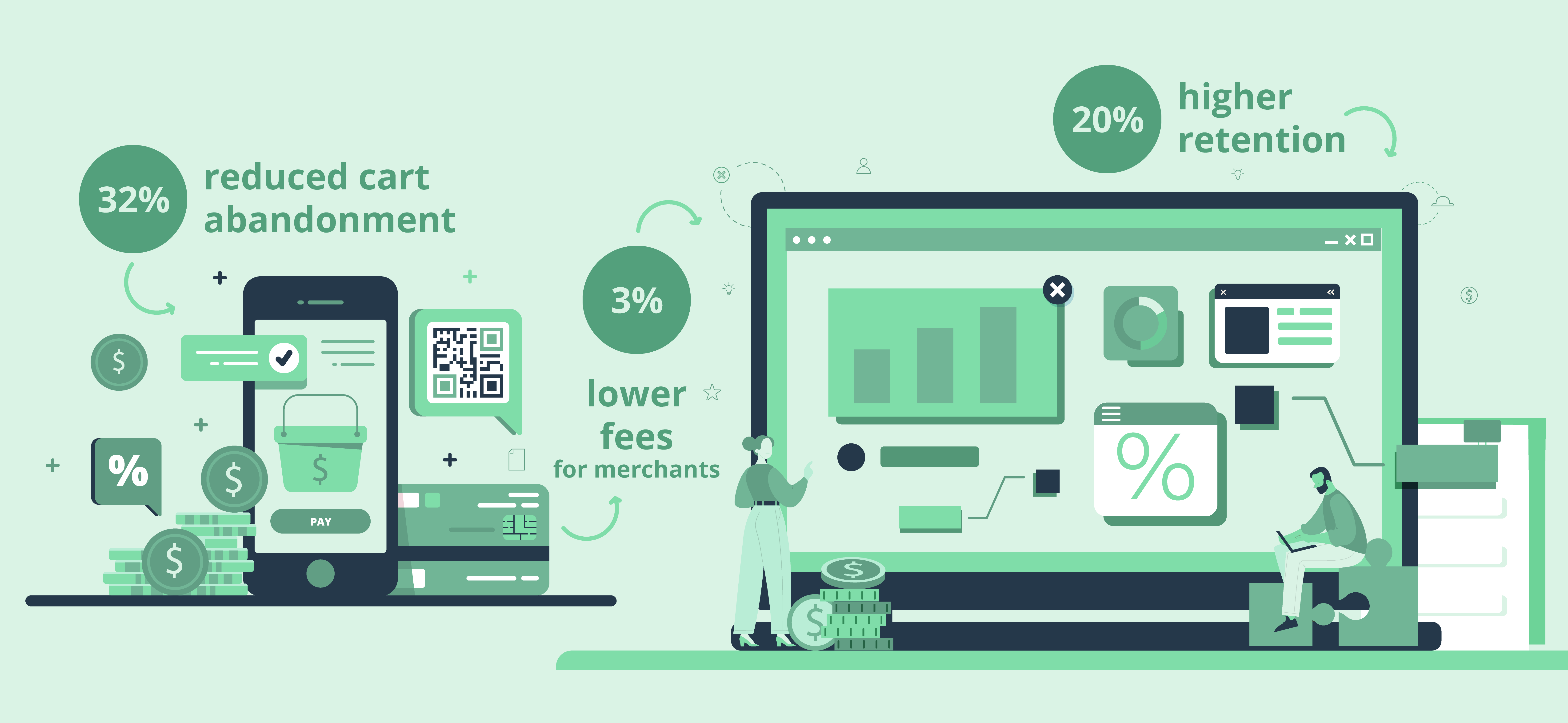

Open banking offers a solution by enabling payments directly from customer bank accounts, eliminating the need for card networks and their associated fees. Payment methods such as ACH (Automated Clearing House) can reduce transaction costs to a fraction of a cent. By switching from card networks to open banking solutions, businesses can instantly improve their margins on every sale.

Practical examples: Consider a business generating $1 million in revenue with an average transaction fee of 2.5%. That’s $25,000 lost to transaction fees. By adopting open banking, which could cut fees down to minimal levels (e.g., $0.02 per transaction), the business stands to save tens of thousands of dollars, which can then be reinvested into growth initiatives. For high-volume businesses, this is a substantial and recurring financial benefit.

In summary, reducing transaction costs via open banking and other modern payment methods offers a straightforward path to improving profit margins. This strategy not only helps cut down costs but also positions businesses more competitively by allowing them to offer customers lower prices or invest those savings into enhancing their offerings.

Strategy 2: Minimizing Cart Abandonment with Seamless Payments

One of the biggest challenges for online businesses is cart abandonment, where customers start the checkout process but leave before completing their purchase. Industry data shows that the global average cart abandonment rate is around 69%, meaning businesses are losing significant potential revenue at this crucial stage. A major factor in this high abandonment rate is the friction customers face during payment. Complicated checkout processes, unexpected fees, or limited payment options can all lead to drop-offs.

How smoother checkout experiences lead to higher conversion rates is clear: when businesses streamline the payment process—making it faster, more intuitive, and flexible—they reduce the likelihood of customers abandoning their carts. Open banking and other real-time payment options allow for frictionless checkouts, eliminating steps like entering card details or dealing with redirect pages. By integrating “Pay by Bank” options or enabling one-click payments, businesses can significantly improve the user experience, increasing the chances that customers will complete their transactions.

Additionally, the role of payment services and secure, reliable options cannot be overstated in reducing cart abandonment. Open banking facilitates instant bank transfers, giving customers confidence that their payment is secure and completed in real-time. This reduces waiting times and removes the fear of payment failures, which are common with card payments due to fraud prevention measures. The reliability of bank-level authentication also minimizes false declines, further improving conversion rates and helping businesses retain more revenue.

Strategy 3: Increasing Retention by Reducing Involuntary Churn

Involuntary churn—when customers are lost due to failed payments rather than intentional cancellations—is a critical issue, particularly for subscription-based businesses. Studies indicate that nearly 50% of churn is involuntary, often caused by payment failures due to. This type of churn can erode a company’s customer base and revenue over time.

Tackling churn caused by failed payments is where open banking offers a reliable alternative. Unlike credit cards, which have expiry dates and can be lost or stolen, bank accounts are “evergreen” and much less prone to failure. By allowing customers to make direct payments from their bank accounts, open banking reduces the risk of declined payments, helping businesses maintain a steady flow of recurring revenue. Additionally, payment initiation services (PIS) allow businesses to automate and initiate secure, verified payments directly from a customer’s account, avoiding the issues of card expiration or insufficient funds in real time

Retention strategies for subscription-based businesses can be significantly enhanced by incorporating open banking. Automating payments through open banking APIs ensures a seamless experience for customers, reducing the likelihood of payment failures. Additionally, by offering flexible payment schedules and personalized communication (e.g., alerts before an upcoming payment), businesses can further enhance the customer experience, increasing loyalty and reducing churn. Providing options for customers to update their payment methods easily, combined with the reliability of open banking, creates a win-win situation where both the business and the customer benefit from a stable payment relationship.

By addressing involuntary churn head-on, businesses can keep customers engaged and reduce the need for costly reacquisition efforts, directly impacting their long-term revenue growth.

Strategy 4: Enhancing Internal Operations with Optimized Payment Services

To drive more revenue from online business operations, enhancing internal payment processes is crucial. Leveraging advanced and streamlined payment systems enables businesses to improve efficiency, ensure secure transactions, and offer multiple payment options to customers. This strategy focuses on maximizing financial operations by adopting intuitive, robust payment solutions that cater to customer demands and support business growth.

Efficient payment management becomes possible through Monetum Pay’s comprehensive account management solutions that provide full control over transactions, including the ability to manage multiple IBANs from a single interface, instant payment capabilities.

Security is further enhanced by employing advanced transaction processing systems that encrypt and protect sensitive data during every financial transaction. Additionally, flexible integration through robust APIs enables seamless incorporation of payment processes into existing systems, automation of payouts and deposits, and effective mass payment management. By optimizing payment processes, businesses can lower operational costs, increase payment speed and reliability, collectively driving revenue growth.

Strategy 5: Expanding into New Markets with Localized Payment Methods

As online businesses grow, expanding into new markets presents significant opportunities for revenue growth. However, global expansion also brings challenges, particularly when it comes to payment preferences. Customers in different regions often prefer localized payment methods, and businesses that fail to accommodate these preferences risk losing sales.

The advantages of offering multiple payment options for a global customer base are clear. By providing localized payment methods such as bank transfers, digital wallets, and region-specific payment solutions, businesses can increase their appeal to international customers. Open banking facilitates this by enabling businesses to offer direct bank payments across borders, reducing the need for currency conversions and eliminating the high fees associated with international card transactions. This flexibility gives customers a frictionless payment experience, increasing the chances of completing the purchase

Strategies for entering new markets using localized payment systems include researching the most popular payment methods in target regions and integrating those options into the checkout process. For example, in Europe, many consumers prefer “Pay by Bank” options due to their security and ease, while in Asia, digital wallets are often favored. By offering region-specific payment methods, businesses can build trust with customers and overcome the barrier of unfamiliar or less preferred payment options. Additionally, utilizing open banking can speed up the entry into new markets by simplifying regulatory compliance and ensuring secure, compliant payment flows

In conclusion, offering multiple, localized payment options not only enhances the customer experience but also opens the door to new revenue streams in diverse markets, helping businesses scale globally with minimal friction.

Conclusion: Unlocking Growth Potential with Strategic Payment Solutions

The five strategies outlined in this guide offer a clear roadmap for online businesses looking to drive revenue growth by optimizing their payment systems. From reducing transaction costs and minimizing cart abandonment to increasing retention by cutting involuntary churn, leveraging customer data for upselling, and expanding into new markets with localized payment methods, each of these approaches contributes to long-term profitability.

Recap of the five strategies and their long-term impact on revenue growth:

- Reducing transaction costs: Open banking and modern payment solutions can significantly lower fees, directly improving profit margins.

- Minimizing cart abandonment: A seamless payment process ensures higher conversion rates, reducing the number of lost sales at checkout.

- Increasing retention: By preventing payment failures, especially for subscription-based models, businesses can stabilize their revenue streams.

- Leveraging data for upselling: Data insights allow businesses to offer personalized recommendations, increasing customer lifetime value.

- Expanding into new markets: Offering localized payment methods makes it easier for businesses to grow globally, capturing new customer segments with ease.

Looking ahead, the future of payment innovation will continue to focus on flexibility, personalization, and security. With the rise of open banking, businesses can expect to see more seamless integrations that allow for real-time payments, better fraud prevention, and improved customer experiences. Staying ahead of these trends will be crucial for businesses aiming to maximize their growth potential.

To stay competitive and unlock the full potential of your business through strategic payment solutions, talk to an expert from Monetum Pay today. Our team can help tailor the right payment strategies for your specific needs, ensuring your business is well-positioned to grow in a rapidly evolving market. Reach out now to explore how we can help you drive long-term revenue growth.

Ready to Drive Your Business Growth?

Unlock the full potential of your online business with optimized payment solutions that reduce costs, improve customer retention, and increase revenue. Take the first step toward growth by opening an account with Monetum Pay today. Whether you want to streamline payments or expand into new markets, we’re here to help you succeed.

Open your account now and start benefiting from smarter payment strategies tailored to your business needs!